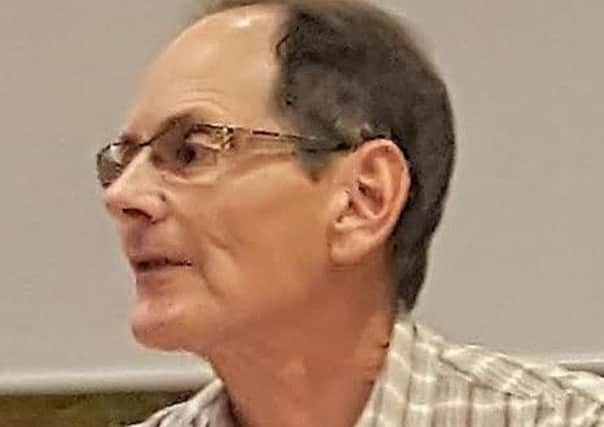

Politically Correct by Ken Cridland

We are all living longer they say. No, all of us are not!

Life expectancy varies quite widely and many people in Blackpool don’t live long lives.

The biggest variations can take place over a few miles. In Manchester’s Deansgate-Castle Field area, it is 85.6 years. Down the tramline at Victoria, it is 70.2 years.

Advertisement

Hide AdAdvertisement

Hide AdIn London in the Embankment and Temple areas it is 92.9 years, while down the District Line at Ravenscourt Park it is 74.7 years.

In parts of Blackpool, the average man will not reach his 72nd birthday.

Yes, being in a different area and social class, with widely varying incomes, housing standards, way of life etc can make a difference to your life expectancy of over 20 years.

If the State Pension Age does move up to 70 years, the chances for those at the wrong end of these statistics ever seeing their state pension will be much slimmer.

Advertisement

Hide AdAdvertisement

Hide AdPensions are now generous they say. Therefore we need to keep pension rises down. No they are not!

Actually, a House of Commons 2015 research paper pointed out that amongst 34 OECD countries, the UK’s state pension ranked 32nd.

Even taking into account the higher levels of income from occupational pensions in the UK, we still only move up to 22nd.

There will be too many old people they say. Increasingly we hear that old people will be a burden and that it is not right that they take up an increasing proportion of national spending.

Advertisement

Hide AdAdvertisement

Hide AdNow ask yourself, if there is a baby boom on the way, will we also hear this is a burden, that the proportion of national spending on children must be kept down, that extra school places will be too expensive?

The way some people talk about older citizens tells us a lot about how those people think.

So, in whose interests are we being fed lies and half-truths? The answer to that question will also tell us what we need to do to get fair and reasonable pensions.

More elderly folk in future

So when we hear that more changes are being planned for our pensions, we should be wary, very wary, even afraid.

An independent reviewer will soon report to Government.

Advertisement

Hide AdAdvertisement

Hide AdHe has consulted widely, including gathering some evidence last October in Blackpool, as reported in the Gazette.

There is already an interim report out. I know all this particularly well, because that independent reviewer, John Cridland, is my brother.

To be fair to John and his team of civil servants from the Department for Work and Pensions, he has spotted most of the issues which are outlined above.

The issues, and the figures quoted are in John’s interim report issued last October. However, he has hit a big buffer.

Advertisement

Hide AdAdvertisement

Hide AdWorkers are taxed over their working life to pay for pensions.

However, the money is not saved, but used immediately to pay for state pensions at the time of collection.

In the future, the population will have a bigger proportion of pensioners, because there are fewer younger people being born, and people are expected to live longer on average.

At the same time, the wages of workers are stagnating or even coming down in real terms, so the Government will not be getting enough taxes from them to pay for state pensions.

Advertisement

Hide AdAdvertisement

Hide AdThere is a very telling graph on page 36 of John’s interim report showing the present poor income of the working age population, now little better than that of the pensioner population.

How can he be fair to all the pensioner generation, especially those who are poor and are not expected to live for so long, while also being fair to the younger working generation?

Time to share the wealth

So, what will the Government decide to do?

We can have a good guess it will include some or all of the following – reduce pension increases, raise the state pension age again, remove automatic pensioner allowances such as bus passes,increase taxes.

However, there is an alternative – because it is not pensioners who are sucking the wealth from us.

Advertisement

Hide AdAdvertisement

Hide AdIn a world of increasing inequality, where 62 rich people have as much wealth as half the world’s population, and where austerity has been a cover for making this situation worse, it is pretty obvious where the money has gone.

There can be decent pensions and workers can be paid decent wages, but for this to happen we have to take on the richest and most powerful one per cent.

At present, it appears governments either consist of that one per cent or are under their control. For the 99 per cent to get justice over pensions, the one per cent have to be confronted.