REVEALED: The millions lost to our vital Blackpool Council services through the tax relief on empty shops

and live on Freeview channel 276

Blackpool Council missed out on £1.9m last year through tax breaks for newly vacated premises, while Fylde and Wyre lost close to £600,000 each.

As councils have seen their government grants slashed, public finances have become increasingly reliant on other sources of income.

Advertisement

Hide AdAdvertisement

Hide AdBusiness rates were worth £42.6m to Blackpool last year but an investigation by the BBC Shared Data Unit has revealed that empty premises relief – which exempts landlords from paying the tax for at least three months – cost the resort almost £10m over the last five years.

But hard-pressed retailers have been calling for urgent reform of the business rates system which they say is out of date and hits them too hard at a time when the high street is seeing increasing closures of stores.

In Blackpool, the average amount lost annually over the past five years due to tax relief on empty properties was £1.9m. Fylde lost out on around £630,000 and Wyre around £610,000.

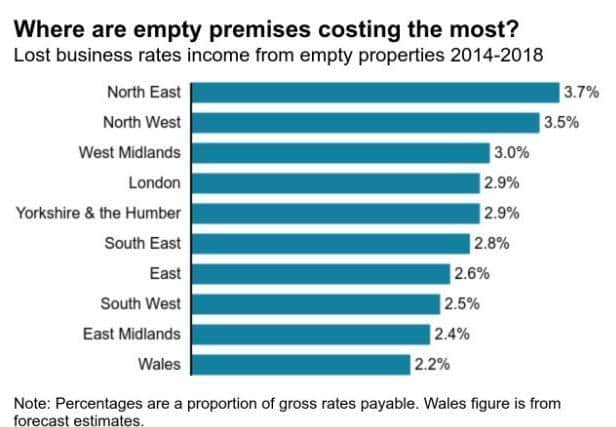

However, the proportion of total rates income lost to the tax relief was lower on the Fylde coast than the North West average of 3.5 per cent.

Advertisement

Hide AdAdvertisement

Hide AdBusiness rates are based on a property’s “rateable value”, which is linked to rental value.

Under law, empty business premises cannot be taxed under the business rates system for at least three months, so when shops and factories close suddenly, it can result in big shortfalls in council funds. Some businesses can get extended empty property relief. Industrial premises, for example, are exempt for a further three months and listed buildings are exempt indefinitely.

The government has promised councils 75 per cent retention of any growth in business rates from April 2021 in return for the huge cuts in central funding.

Leader of Blackpool council Simon Blackburn, said: “The council has no choice other than to administer the business rates system in accordance with national legislation. This includes a period following the vacation of a business where business rates are not payable.

Advertisement

Hide AdAdvertisement

Hide Ad“This is not a new position and a rate-free period in such cases has been in place since business rates were introduced in 1990.

“It is therefore not a loss as such as an estimate is made each year to account for these cases.

“Clearly, business rates are major source of income to both the council and to the government as the income collected is shared between both. The council does all it can to maximise the amount collected following the calculation of the liability of occupiers or owners of businesses.

“Blackpool is also driving forward an exciting and ambitious £100m regeneration programme which will attract more businesses to set up their operations and thrive in the town which has the potential to contribute to business rate income.”

Advertisement

Hide AdAdvertisement

Hide AdIn October, a select committee urged reform for a “broken” business rates system.

Dr Kevin Muldoon-Smith, who provided evidence for the inquiry and runs consulting agency R3intelligence, said: “Business rates, along with council tax, will be very critical to the stability of local authority finances going forward because of central government grants being reduced.

“Unfortunately, we have this perverse situation where local government needs tax to go up and the business community are lobbying very hard for it to go down.”

“But if you look at the property market, the relationship between business and bricks and mortar is changing.

Advertisement

Hide AdAdvertisement

Hide Ad“There’s a good chance that pool of income will start to reduce – at the very least it will be different.”

His business partner Prof Paul Greenhalgh said: “Some vacancy might be due to businesses moving on, not closing down. They might be expanding and climbing the property ladder.

“If that vacated property is then re-absorbed in the local economy that can be quite a positive thing. I think the problem is when the unit continues to be vacant, sometimes for months or even years.

“The more empty property units you have hanging around, that can start blighting an area.” Richard Watts, chairman of the Local Government Association’s Resources Board, said:

Advertisement

Hide AdAdvertisement

Hide Ad“Business rates are an extremely important source of income for local government and, with an overall funding gap of £8bn by 2025, the Government must commit to moving forward with vital reforms, which include addressing business rates avoidance and the impact of reliefs, such as empty premises relief.”

A Treasury spokesman said: “Empty property relief strikes a balance between incentivising property owners to put vacant properties to use, while not penalising those who lose a tenant at short notice.” They added that the results of a review of business rates will be announced “in due course”.

The spokesman added that the Prime Minister had announced a £3.6bn Towns Fund – of which £1bn was to help high streets adapt.

‘Broken tax system’ must be reformed says retail group

Dominic Curran, Property Advisor at the British Retail Consortium, said: “It has been a challenging year for many retailers, as many shops struggle to adapt to rising cost pressures and changing consumer habits. High among the concerns for retail firms is business rates – a tax which disproportionately harms retailers, driving shop closures and job losses, leaving empty shopfronts and harming local communities.

Advertisement

Hide AdAdvertisement

Hide Ad“It is essential that the Government makes good on its pledge to reform this broken tax system.”

The view from the Chamber of Commerce

Alan Welsh, policy manager, at the North and Western Lancashire Chamber of Commerce which covers the Fylde coast said owners of premises do not want to keep them empty as they would not be making any money on them.

He said: “The North may have a higher proportion of businesses claiming empty property tax relief but we have long argued that the government should scrap business rates altogether on empty properties.

“This is yet another unfair tax on business regardless of whether the owner is generating any income from the property.

Advertisement

Hide AdAdvertisement

Hide Ad“We don’t accept the argument that developers and landlords are happy to keep properties empty until they find a tenant willing to pay inflated rents, which was a fundamental reason for cutting empty property relief in the first place.

“If the government wants to do more to help businesses then they need to address the relentless rise in up front business taxes and costs, from sky-high business rates, to the costly introduction of Making Tax Digital and changes to auto-enrolment – all of which is adding to the already onerous cost and administrative burden on firms and is reinforcing the concerns over the current tax regime.”

The need for rates to support local authorities’ income

Councils have long been promised a greater share of their business rates as grants are cut.

It is worked out using a complicated formula, but roughly equates to around 50 per cent each.

Advertisement

Hide AdAdvertisement

Hide AdThe government has promised councils 75 per cent retention of any growth in business rates from April 2021.

Some local authorities already have 100 per cent business rates retention pilots in exchange for additional cuts.

The government reallocates some business rates income from richer authorities to poorer ones through a top-up system. But there have been concerns rates retention could eventually increase disparity between areas.

The Local Government Association has estimated the gap between funding needs and revenue will be £8bn by 2025.