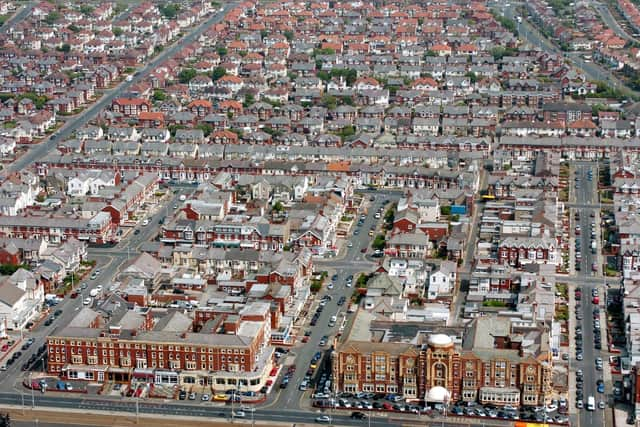

Blackpool targeted by buy-to-let property investors as staycations boom

and live on Freeview channel 276

And with millions being poured into Blackpool’s continued regeneration, it looks like a good bet for the long term too says one Fylde coast property specialist.

Luke Robinson from Vincents Solicitors said buying property as a business investment is attractive as bank interest rates remain low.

Advertisement

Hide AdAdvertisement

Hide AdHe said: “The residential property market is the busiest I’ve ever seen it, due mainly to the pent-up demand after lockdown and the Stamp Duty Holiday which will see activity remain high until it comes to an end in September.

“But a large portion of the activity is Buy to Let investments which don’t benefit from the Stamp Duty Holiday, so there are clearly other factors at work.

“There’s a good mix of purchasers, from out-of-town investors building portfolios to locals looking for a better alternative to the banks for their savings, in a market with yields averaging 7 per cent but heading up to 12 per cent which is hugely attractive.

“With such low sale prices, Blackpool has always been popular with investors buying up old hotels and B&Bs.

Advertisement

Hide AdAdvertisement

Hide Ad“But we’re also seeing activity from local people in individual flats or small blocks for serviced apartments, and a lot of interest in Lytham and St Annes where purchase prices are much higher, which points to a slightly different trend.

“There’s definitely an increase in buyers looking towards short-term holiday lets rather than the traditional residential rental market, with apartments proving particularly popular.

“The first question we get from many buyers is to check if there are any covenants or regulations which would prevent the unit from being rented out short term.

“As most flats are bought on a leasehold arrangement, with the leaseholder able to make specific stipulations, this can be a sticking point."

Advertisement

Hide AdAdvertisement

Hide AdHe said that it was not hard to see why an investor might want to take advantage of the Staycation Summer of 2021, as families look for an alternative to a package holiday abroad.

He added: “Two bed flats with a sofa bed in the lounge could bring in anything from £80 to £280 per night in the summer, far outstripping the opportunities offered by residential rental.

“It can provide a good return on investment with rates more than double the monthly rent for a week’s let in peak season.

“As we saw at the end of last year, from October to Christmas the Promenade was packed. The millions being invested into new high quality hotels and restaurants, not to mention the planned £300m entertainments complex, will see the local tourist season extended far beyond the end of the Illuminations which typically marks shut down.

Advertisement

Hide AdAdvertisement

Hide Ad“And with the shows and entertainments programme’s starting up again later this summer, bringing in thousands to Lytham’s Wonderhall, and the Winter Gardens securing national events like Six and Friends The Musical, the town’s holiday pedigree is showing through, and the growing trend of holiday let purchases in Blackpool is likely to continue.”

Blackpool Gazette: Thanks for reading. If you value what we do and are able to support us, then a digital subscription is just £1 for your first month. Try us today by clicking here